IRS Crypto 1099 Form: 1099-K vs. 1099-B vs. 1099-MISC

4.8 (358) · $ 26.00 · In stock

Have you received a 1099-K, 1099-B or 1099-MISC form about your crypto? Here’s what you need to know about 1099 forms and what it means for your crypto taxes.

A Crypto Guide to Form 1099-B

Form 1099-DA: What We Know So Far

Form 1099-MISC vs. 1099-NEC Differences, Deadlines, & More

Form 1099 K Vs 1099 Misc

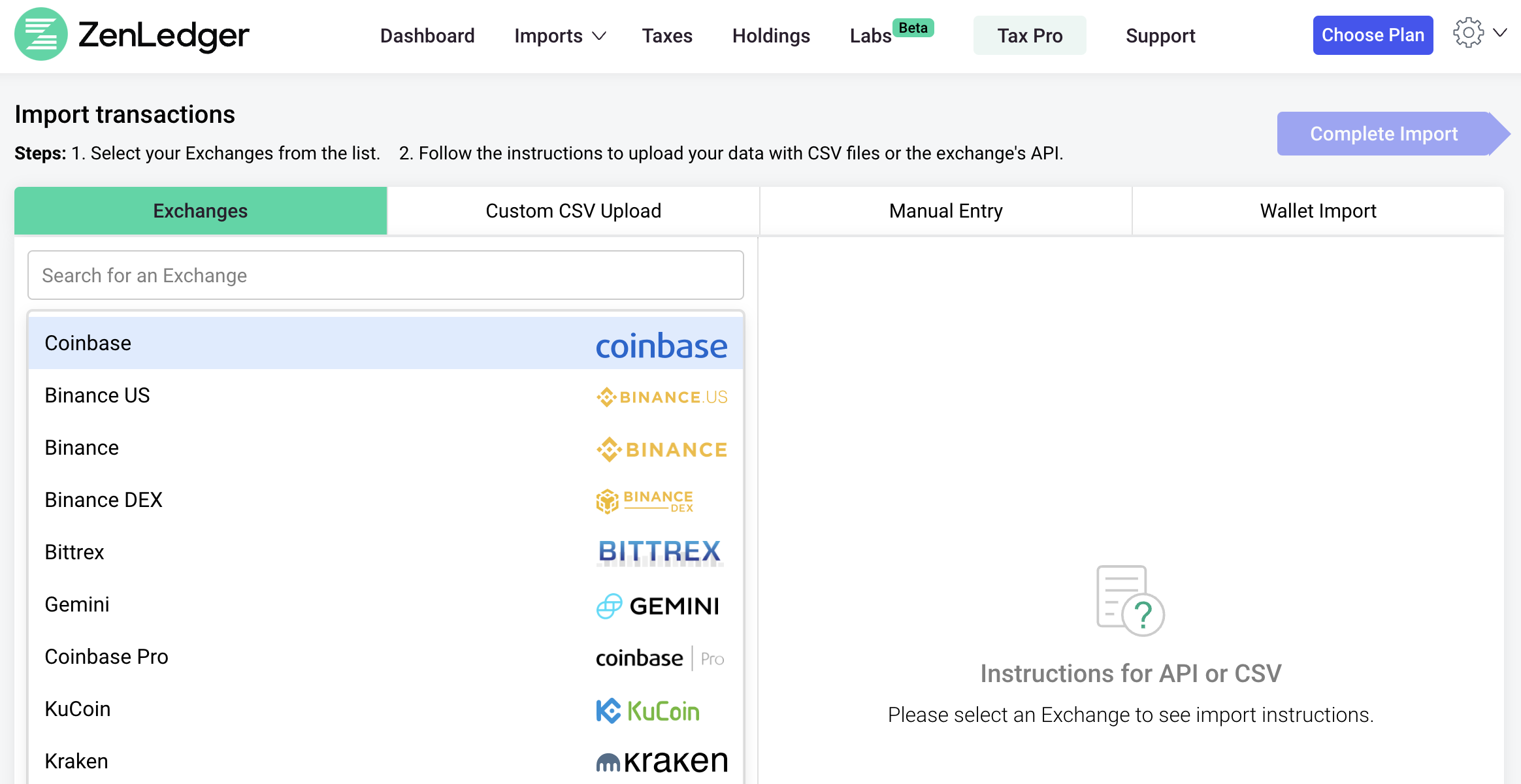

usa Koinly

.jpeg)

Cryptocurrency Form 1099-MISC: Investor's Guide 2024

Clarifications and Complexities of the New 1099-K Reporting Requirements - CPA Practice Advisor

A Crypto Guide to Form 1099-B

1099-MISC + 1099-K Solutions for Double Reporting + PayPal + Coinbase! — Steemit

IRS Form 1099-B walkthrough (Proceeds from Broker and Barter Exchange Transactions)

Everything you need to know about IRS form 1099-MISC for 2023 Tax Year

Difference Between 1099-K and 1099-B Tax Forms From Cryptocurrency Exchanges - TaxBit

:max_bytes(150000):strip_icc()/IRS1099-NEC-d99c3a32d35849eebdfa321d90d023a8.jpg)

Form 1099-NEC: Nonemployee Compensation

Form 1099-K vs 1099-MISC vs 1099-NEC: What's the difference?, by TaxBandits - Payroll & Employment Tax Filings