QQQ ETF: Still Attractive after Dazzling 2023 Gains

4.9 (502) · $ 10.99 · In stock

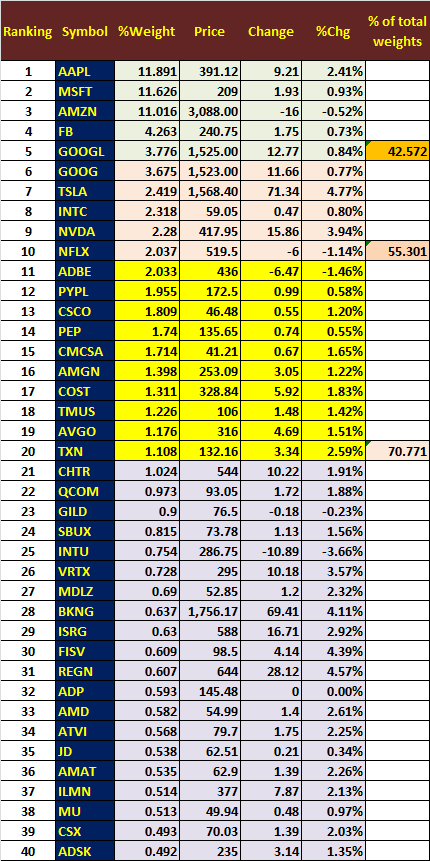

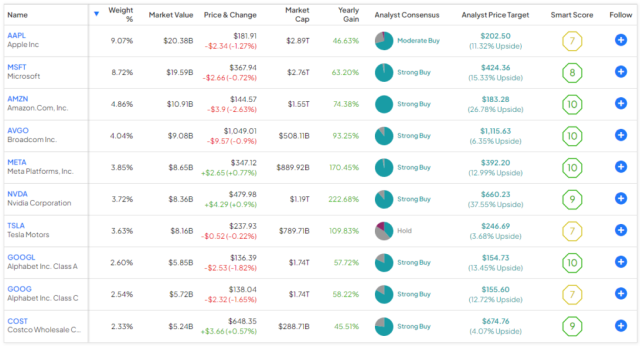

After watching it notch a spectacular gain of around 55% in 2023, many investors likely feel that it’s too late for them to buy the Invesco QQQ ETF (NASDAQ:QQQ). But even after this massive rally, there’s still plenty of reason to own QQQ for the long term. I remain bullish on QQQ based on its strong portfolio featuring many of the world’s strongest and most dynamic companies. QQQ invests in the 100 largest non-financial stocks in the Nasdaq (NDX), making it the home to some of the world’s most

After watching it notch a spectacular gain of around 55% in 2023, many investors likely feel that it’s too late for them to buy the Invesco QQQ ETF (NASDAQ:QQQ). But even after this massive rally, there’s still plenty of reason to own QQQ for the long term. I remain bullish on QQQ based on its strong portfolio featuring many of the world’s strongest and most dynamic companies. QQQ invests in the 100 largest non-financial stocks in the Nasdaq (NDX), making it the home to some of the world’s most

After watching it notch a spectacular gain of around 55% in 2023, many investors likely feel that it’s too late for them to buy the Invesco QQQ ETF

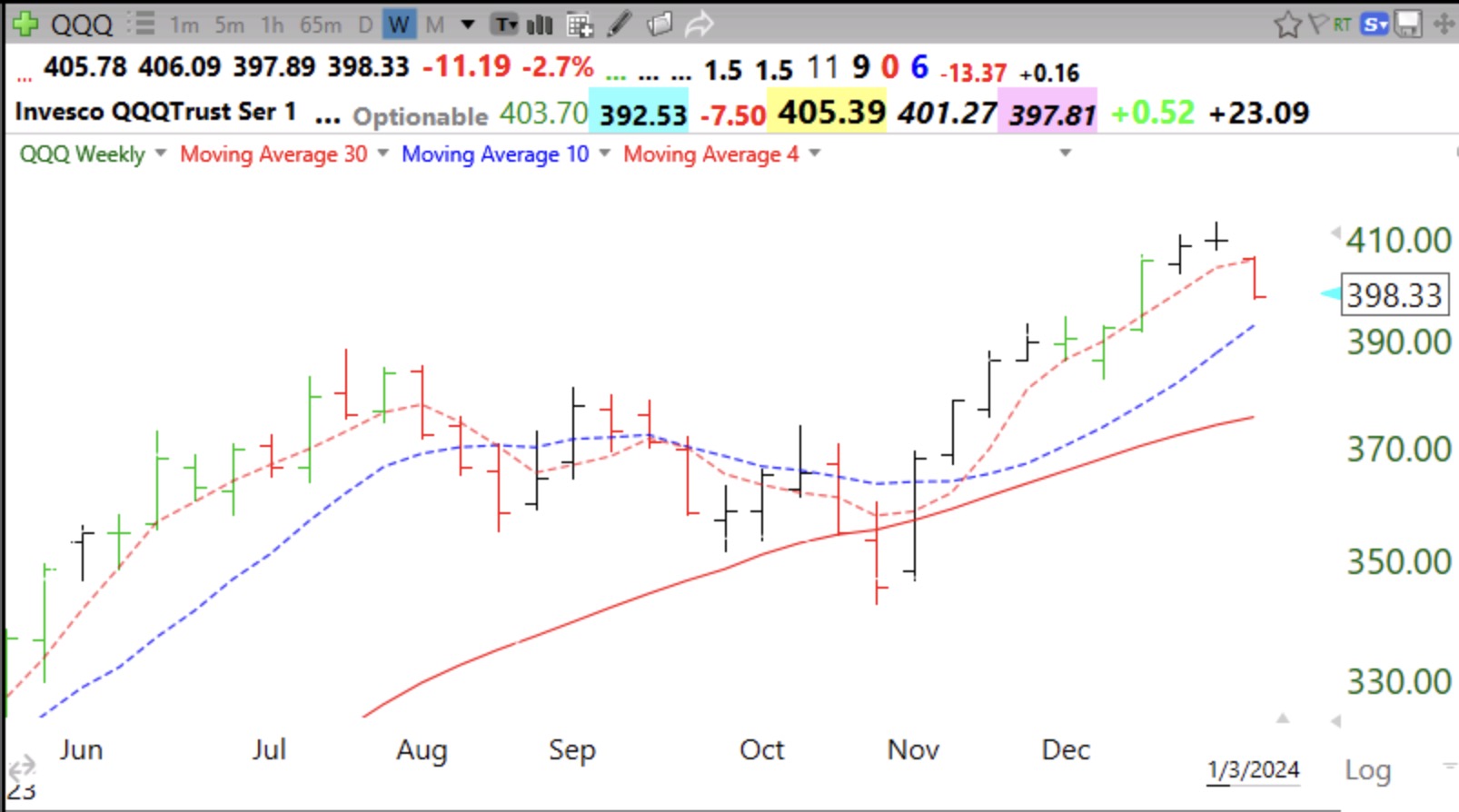

QQQ ETF Update, 12/6/2023

QQQ ETF: Still Attractive after Dazzling 2023 Gains

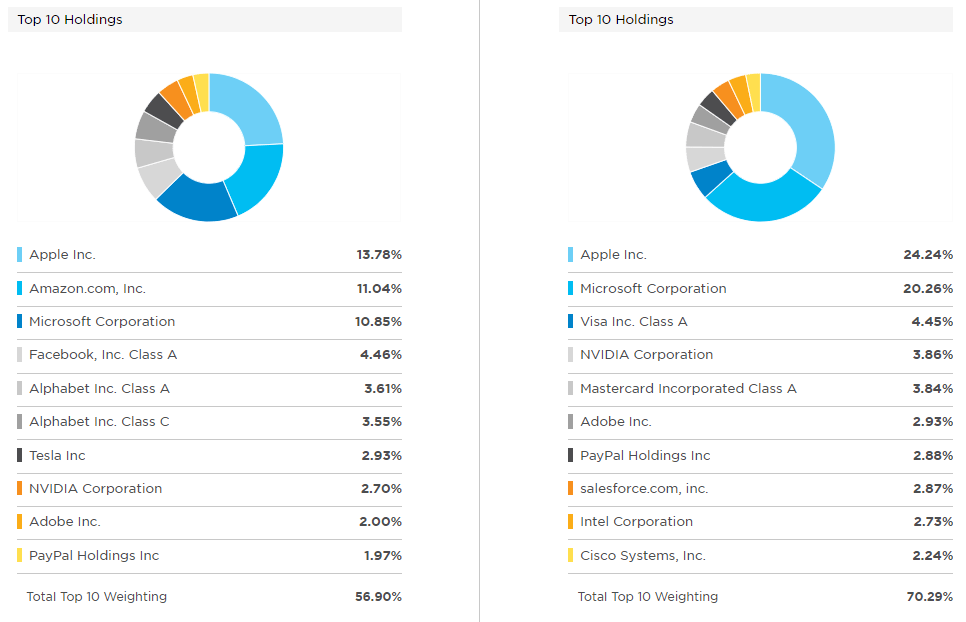

SprinkleBit PowerShares QQQ ETF (QQQ)

QQQ vs. XLK: Which Top Tech ETF is Better?

QQQ: Taking Profits After A 52% YTD Gain Is The Prudent Play

QQQ ETF Update, 12/20/2023

QQQ Isn't Winded After 2023's Big Gain, Experts Say

China Asset Management (Hong Kong) will no longer subadvise 3 Van Eck ETFs

Innovator's defined outcome ETFs notch big jump in trading volume ahead of CPI report

Most Splendid Housing Bubbles in America, Nov. Update: From 2022 Highs, San Francisco -11%, Seattle -10%, Las Vegas -6%, Phoenix -6%, Portland -5%, Denver -5%, Dallas -5%, San Diego…

QQQ ETF Update, 12/12/2023