- Home

- if you

- ITR for Income upto 5 Lakh: Why you should file ITR even if your income is less than Rs 5 lakh - The Economic Times

ITR for Income upto 5 Lakh: Why you should file ITR even if your income is less than Rs 5 lakh - The Economic Times

4.7 (752) · $ 18.00 · In stock

If you have an net taxable income below Rs 5 lakh, then you are eligible for income tax rebate u/s 87A which will essentially make your tax liability nil. Nonetheless you should file ITR because every person whose income is above the basic exemption limit is mandated to do so.

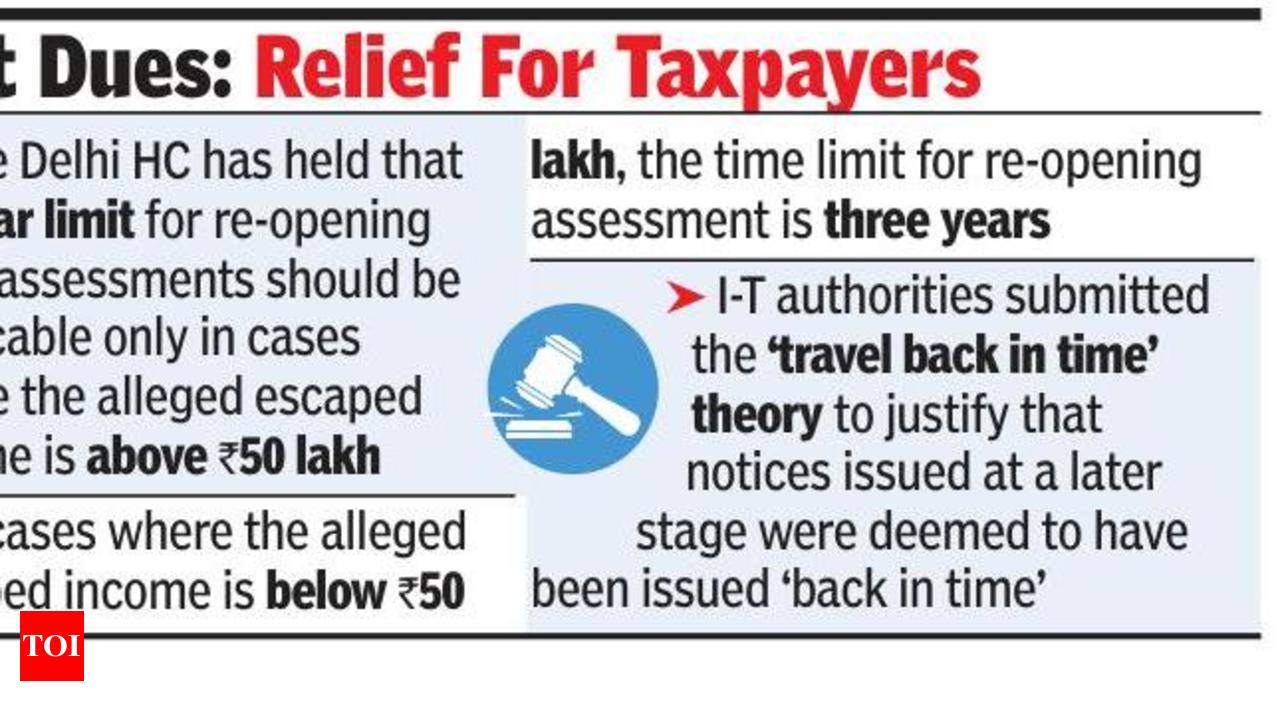

HC: 10-yr period for I-T review applies to income over Rs 50L - Times of India

Income Tax Slabs 2024-25 Budget 2024 Updates: How will Budget 2024 impact you? Taxpayers must know - The Economic Times

ITR filing: How to report income from investments

)

Legal heir bound by law to file deceased's tax return for year of death

Income Tax Returns Income below taxable bracket? 5 reasons why

If total income is more than 50 Lakh including salary, not eligible to file ITR in Form ITR-1

What is Income Tax Return? - Meaning and Benefits

ITR for Income upto 5 Lakh: Why you should file ITR even if your income is less than Rs 5 lakh - The Economic Times

ITR-U BIG UPDATE, LATE FEE FOR INCOME BELOW 5 LAKHS, UPDATED RETURN FILING FOR AY 2020-21 & 2021-22

ITR filing last date 2023: What happens if you miss July 31 ITR filing deadline - Times of India

How selling equities before March 31 can help you save income tax

The tax base is growing – government shouldn't waste the