Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.7 (634) · $ 22.00 · In stock

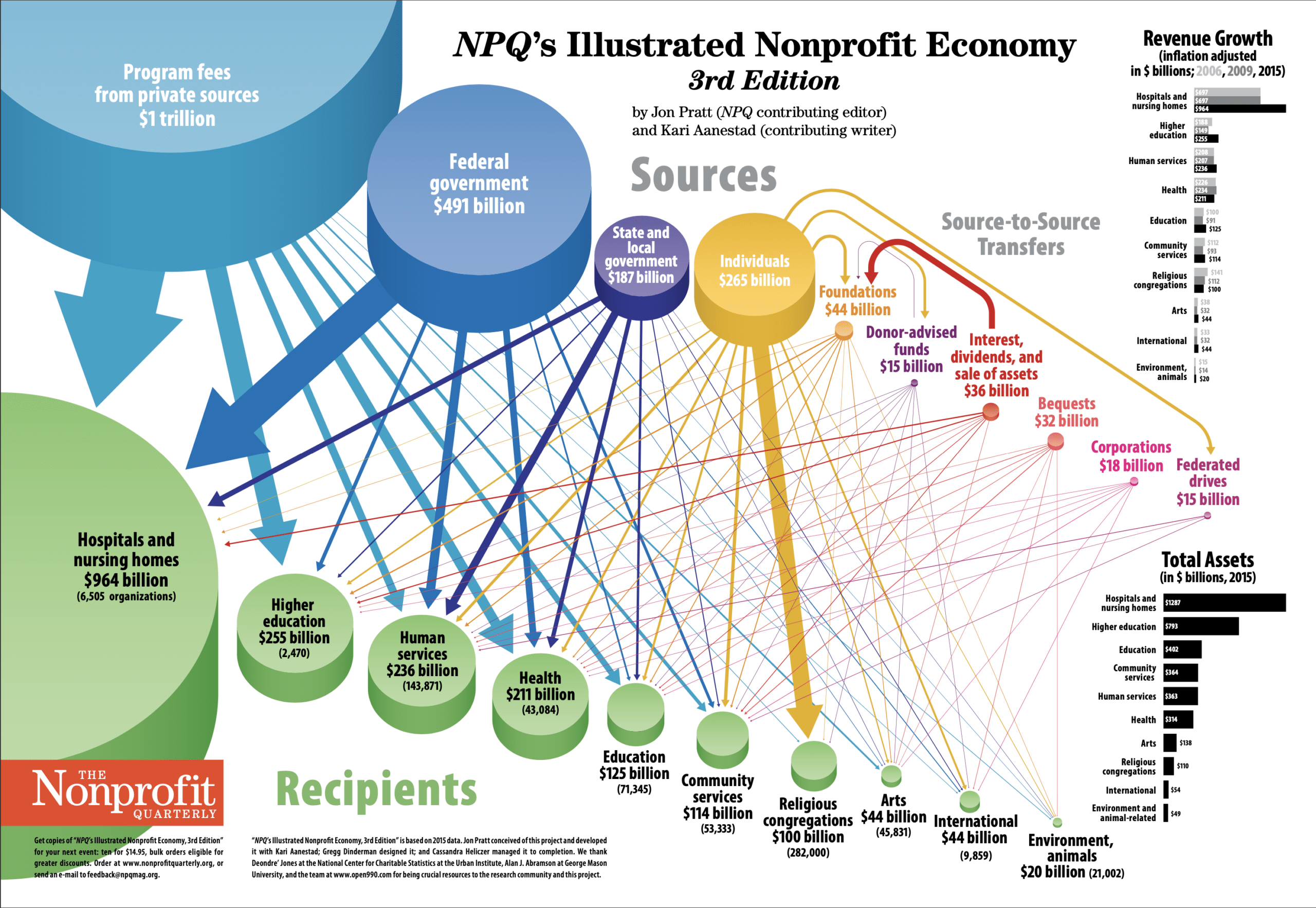

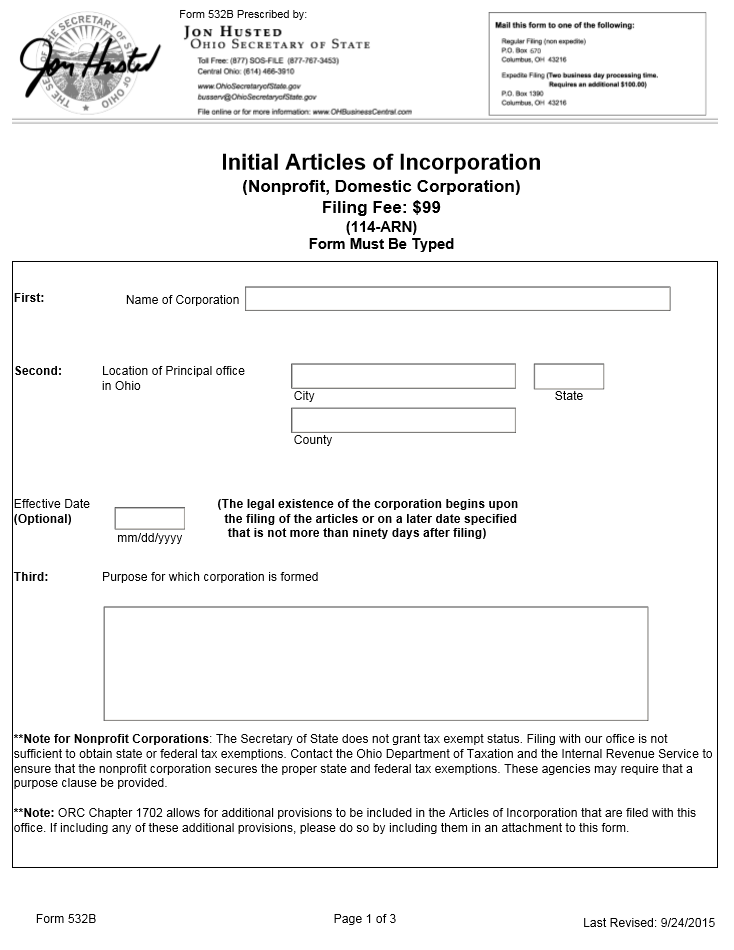

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

Free Nonprofit Bylaws Free to Print, Save & Download

IRS targeting controversy - Wikipedia

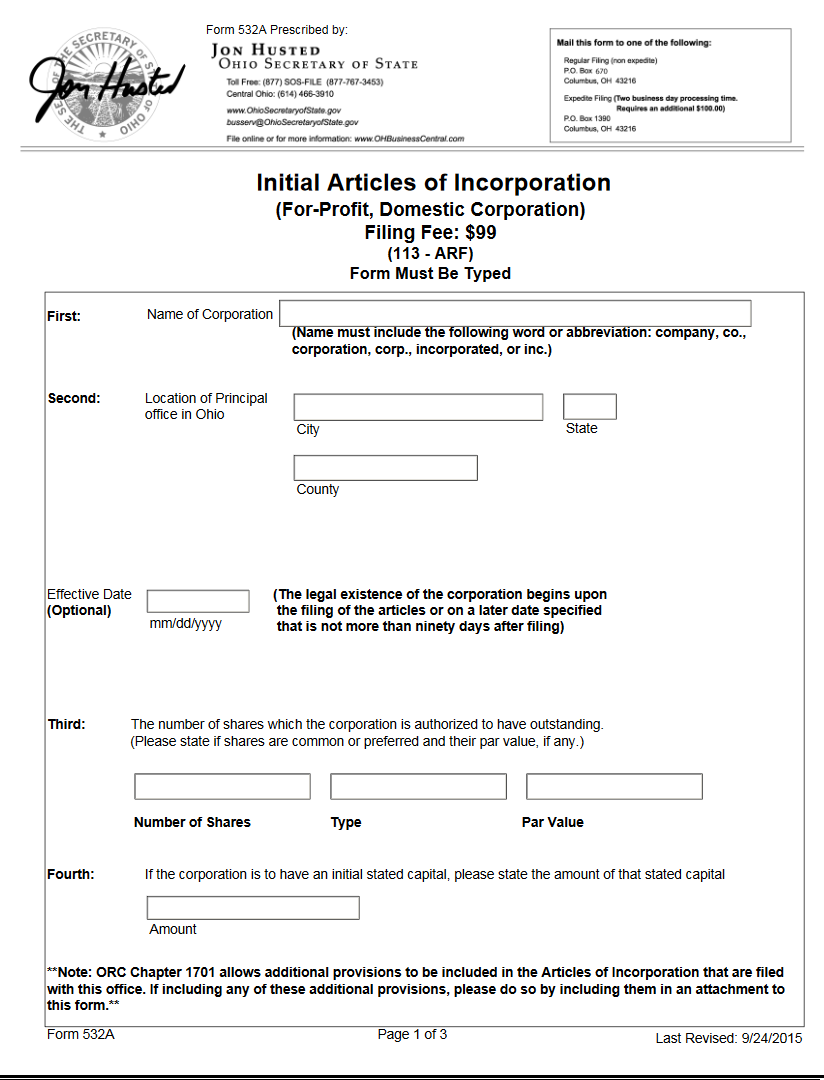

Free Ohio Nonprofit Articles of Incorporation Nonprofit Domestic Corporation

Free Ohio Articles of Incorporation For Profit Domestic Corporation

Charitable Bingo - CHARITABLE OHIO

Nonprofit Bylaws: Complete Guide With Tips & Best Practices

THE Foundation #1 NIL for Ohio State

Nonprofit LLCs - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

Ohio Nonprofit Corporation Law — Homeowners Protection Bureau, LLC

7 Key Differences Between Nonprofit and For-profit Organizations

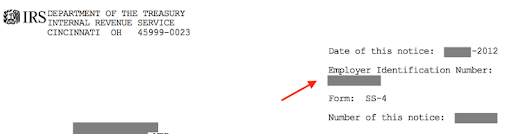

Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?

What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status - Foundation Group®

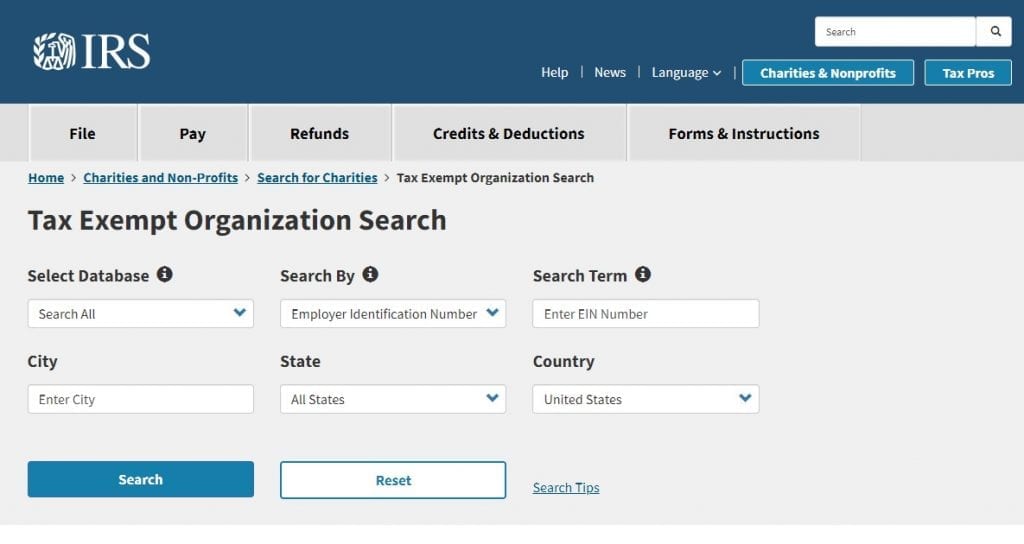

Exempt Organizations Check, IRS Non-Profit Search Tool, Ohio CPA Firm

2024 State Income Tax Rates and Brackets