Form 1040: U.S. Individual Tax Return Definition, Types, and Use

4.6 (615) · $ 10.50 · In stock

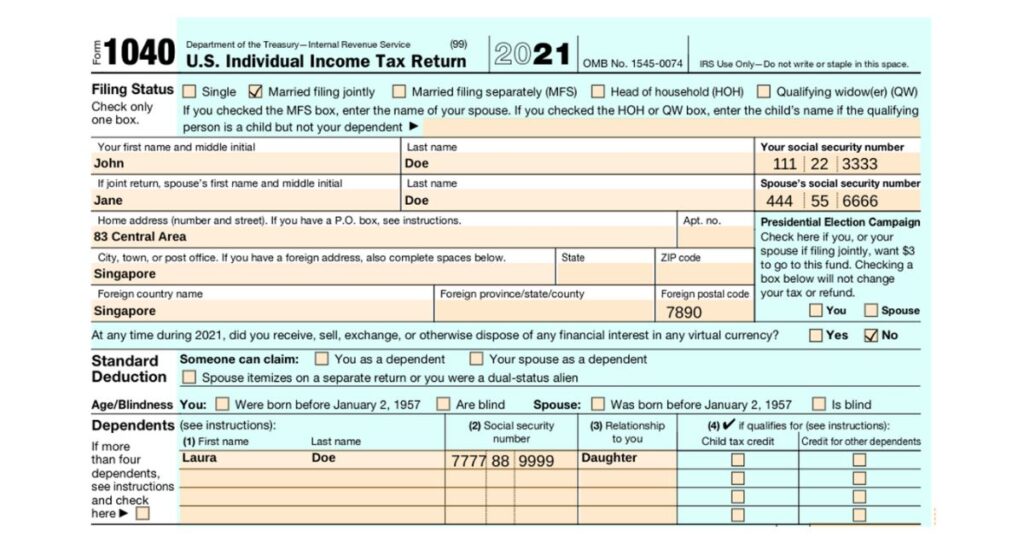

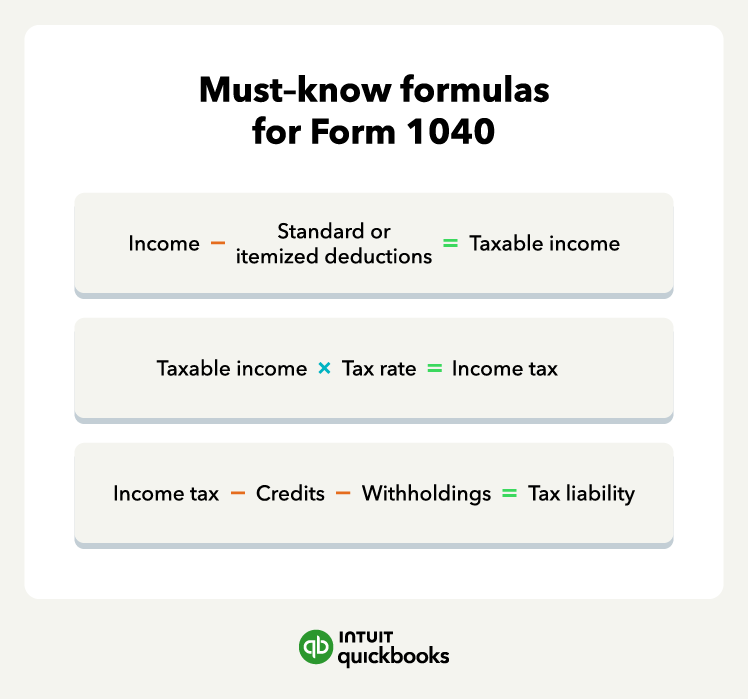

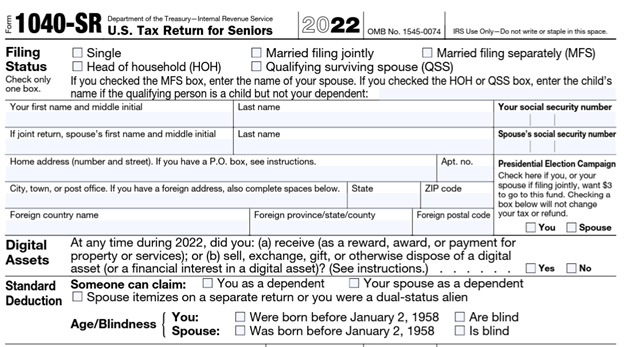

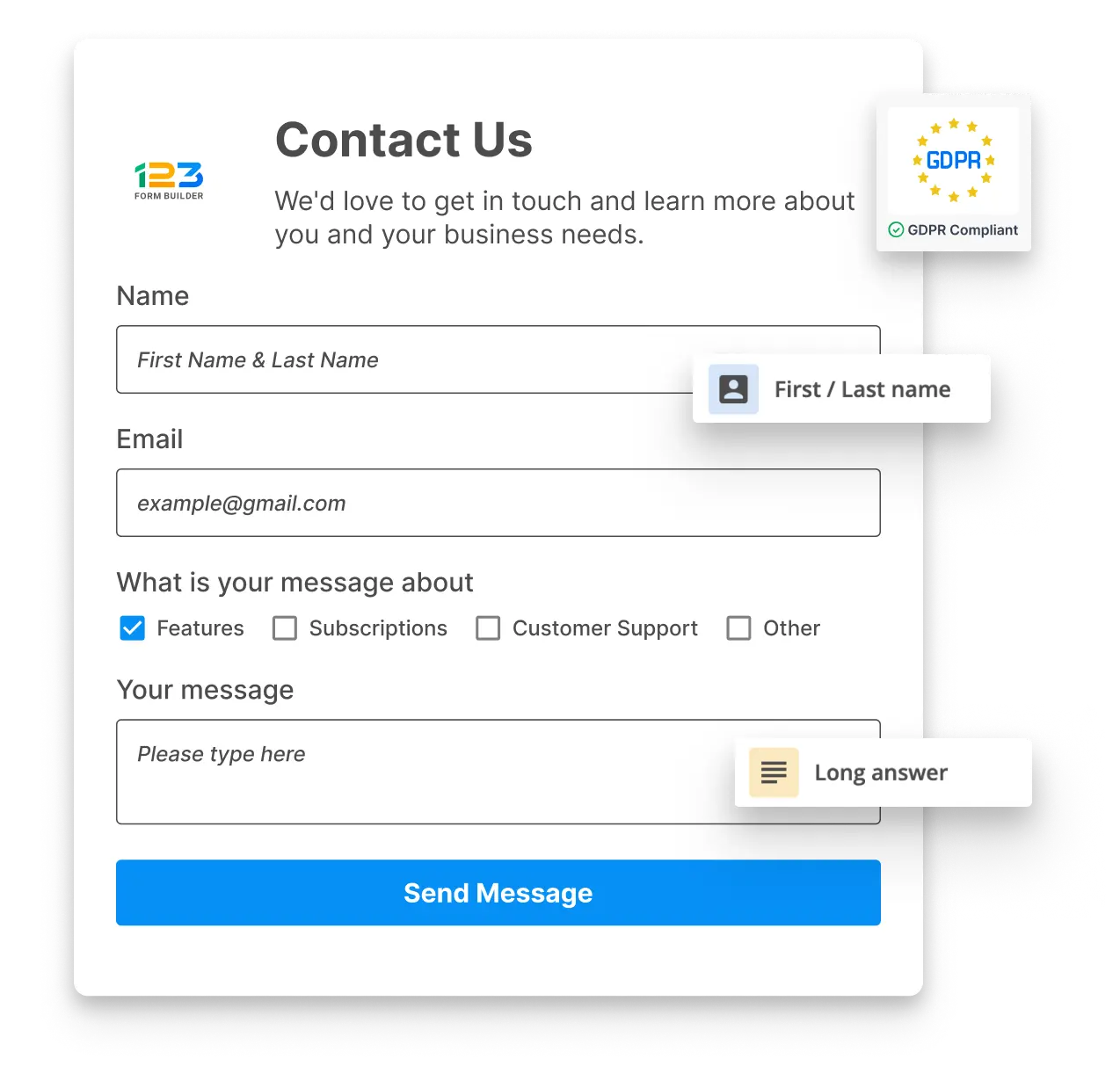

Form 1040 is the standard U.S. individual tax return form that taxpayers use to file their annual income tax returns with the IRS.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040-NR: U.S. Nonresident Alien Income Tax Return Explained

Fillable Form 1040 Schedule C (2016) Tax forms, Irs tax forms, Tax deductions

Mariia Chernetska on LinkedIn: Form 1040: U.S. Individual Tax Return Definition, Types, and Use?

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252: Installment Sale Income: What it is, How it Works

OCR Tax Documents - Extract data from IRS tax forms using OCR

Signing your Federal Tax Return 1040

How to Complete Form 1040 With Foreign Earned Income

How to fill out a 1040 form

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

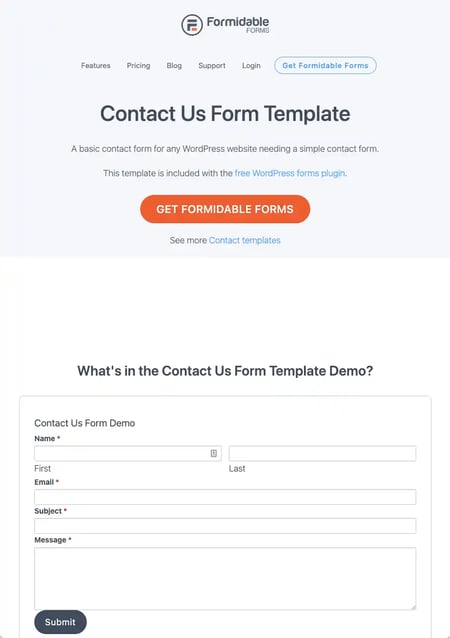

What Is a W-9 Form? Who Can File and How to Fill It Out

Video: How to Figure Out Adjusted Gross Income - TurboTax Tax Tips

:max_bytes(150000):strip_icc()/Form1040-20f7f03402df47acb334f3d02c542332.jpg)

What Is Line 5a on IRS Form 1040?

Form 1040 Line 6: Social Security Benefits — The Law Offices of O'Connor & Lyon

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)

Form 1041: U.S. Income Tax Return for Estates and Trusts

W10 form: Fill out & sign online

Who Should File IRS Form 1040-SR?

:max_bytes(150000):strip_icc():focal(879x452:881x454)/alex-cooper-facts-022423-2-390a5bb1f15b4aecbd7e1153654ecb8c.jpg)

:max_bytes(150000):strip_icc()/1040.asp-final-8113a173a9ce4bf699ffe7e1a5b47156.png)