- Home

- gain the

- What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

4.9 (632) · $ 27.50 · In stock

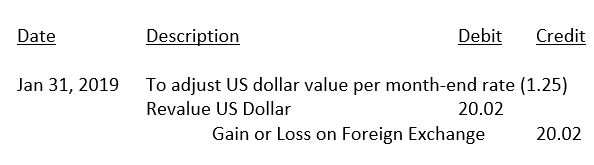

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Foreign currency account balances in Wave – Help Center

What types of journal entries are tested on the CPA exam

CPA 2021 Annual Report and Performance Review by The

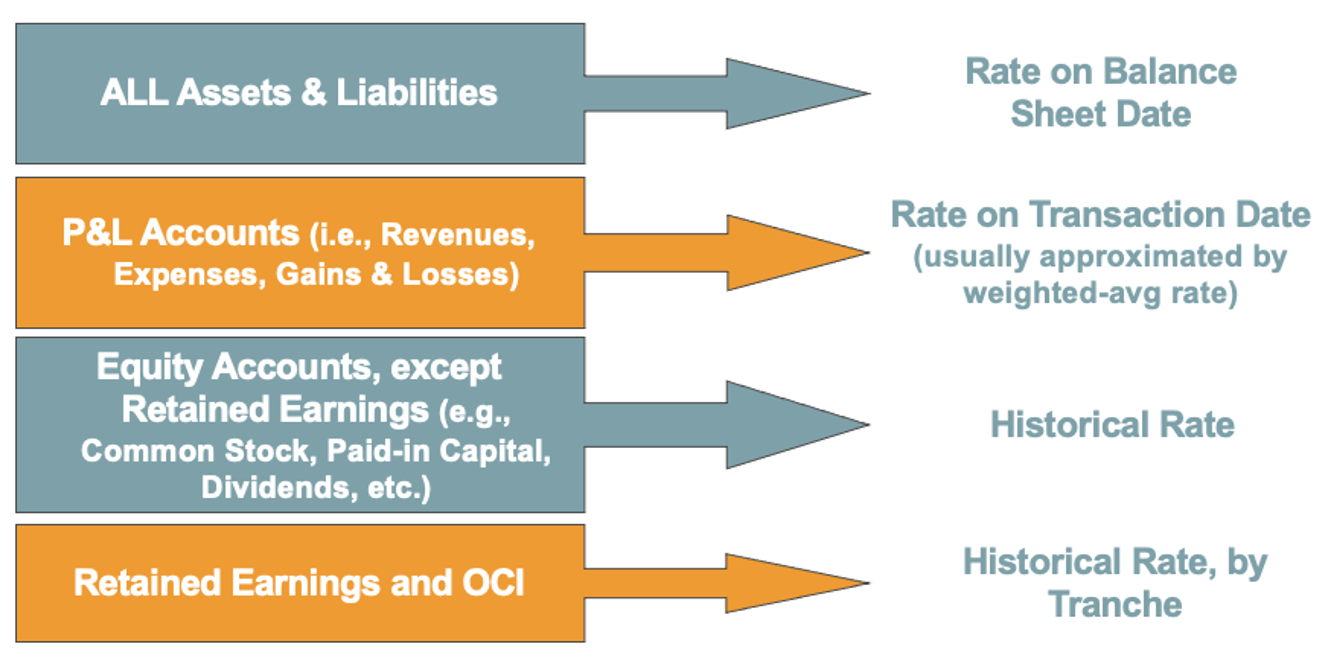

Foreign Currency Matters

How do I record a US$ or other foreign currency transaction? — Young Associates

What Is a Savings Account? - NerdWallet

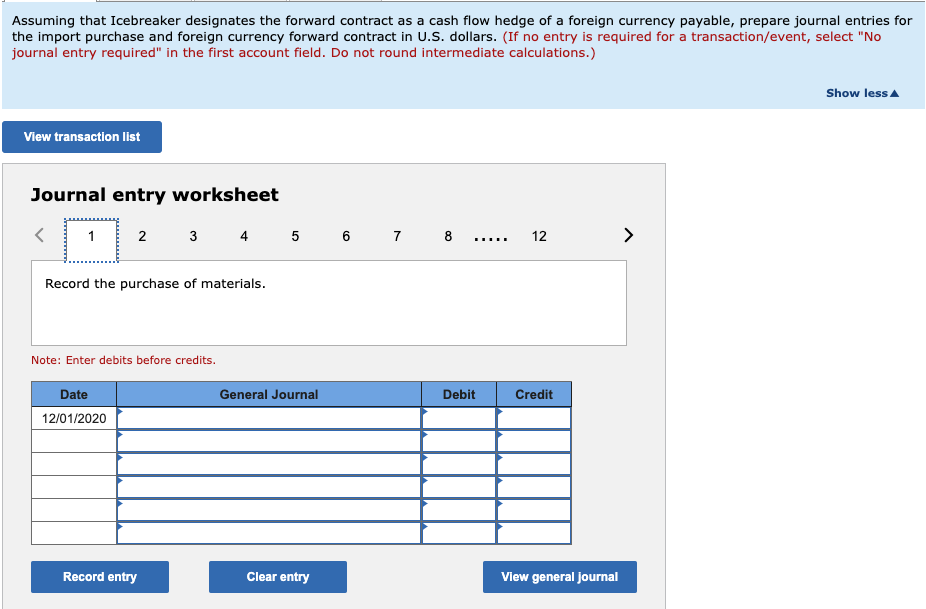

Solved Journal entry worksheet Record the foreign exchange

Accounting For Cryptocurrencies: All You Wanted to Know Know About

4.12 Equity transactions