- Home

- andorra non

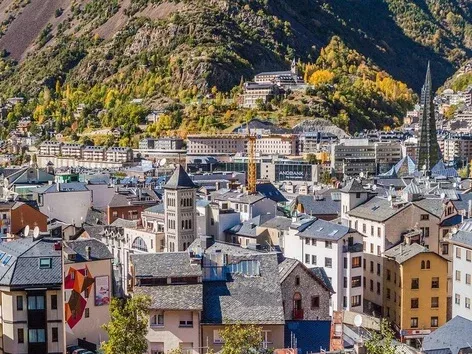

- Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

5 (150) · $ 13.50 · In stock

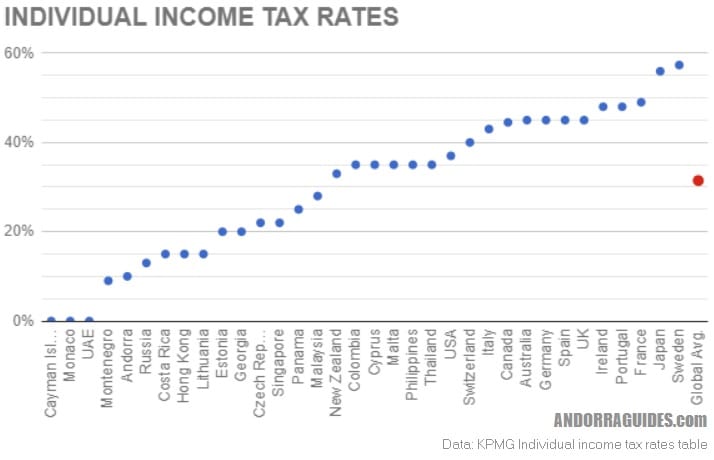

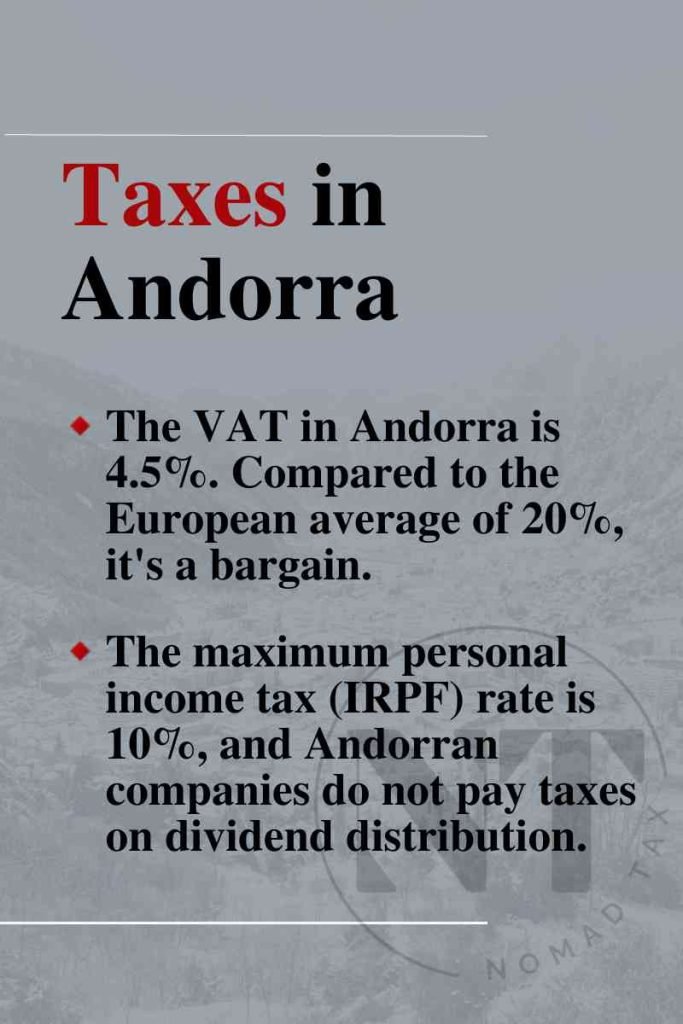

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

The Andorra Tax System

The Full 2024 Guide to Andorra Taxes

The Tax System of Andorra

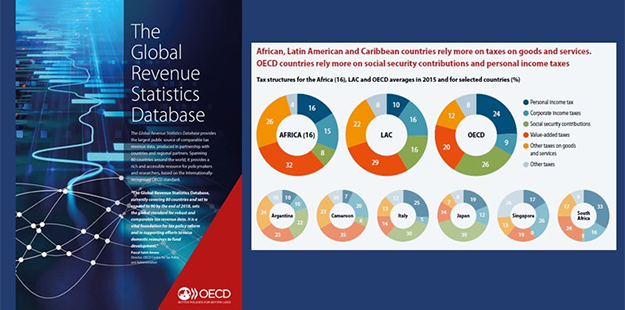

OECD Tax Database - OECD

Taxes in Andorra - Andorra Lawyers

Andorra Crypto Tax

Taxes in Andorra ▷Types and Fees [2024]

Living in Andorra: How to Reduce Taxes with Andorra Tax Residency

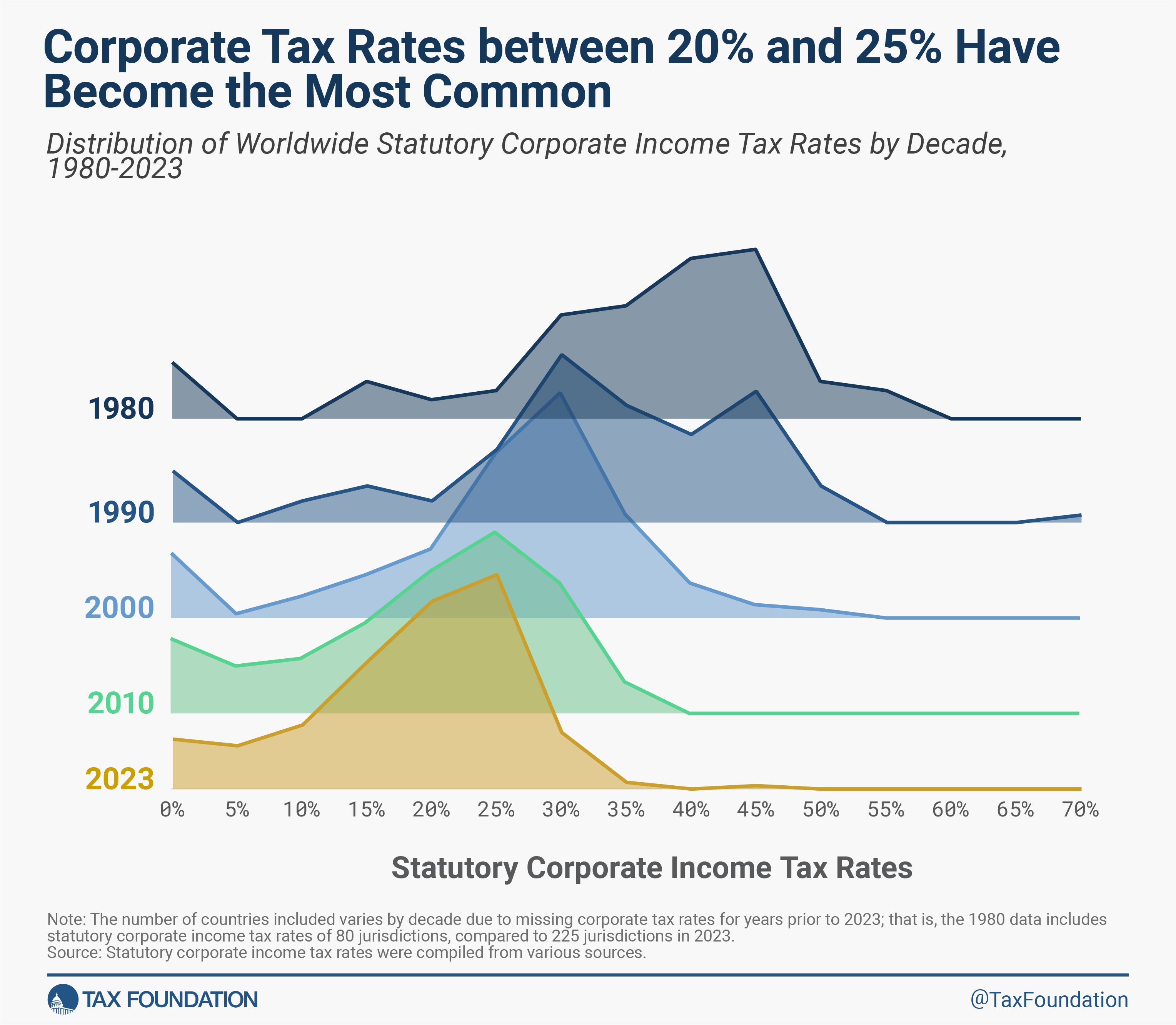

Corporate Tax Rates around the World, 2023

Tax Residency in Andorra, fiscal and Requirements

Tax system: The Small Guide Summarizing Taxes and Fees in Andorra [Updated 2024] - Andorra Lawyers

Tax in Adorra

Taxes in Andorra: how to get a residence permit and become a tax resident

Principality of Andorra: Selected Issues in: IMF Staff Country Reports Volume 2022 Issue 180 (2022)

Impuestos trading en Andorra: ventajas e inconvenientes