Should We Eliminate the Social Security Tax Cap? Here Are the Pros

4.6 (476) · $ 11.50 · In stock

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Calculating Taxes on Social Security Benefits

AARP - You can request federal tax withholding from your Social Security at rates of 7%, 10%, 15% or 25% by completing the IRS form W-4V and sending it to your local

The Peter G. Peterson Foundation on LinkedIn: #socialsecurity #payrolltaxes #taxes

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Dan Tumis (@Dtumis41) / X

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, fica tax

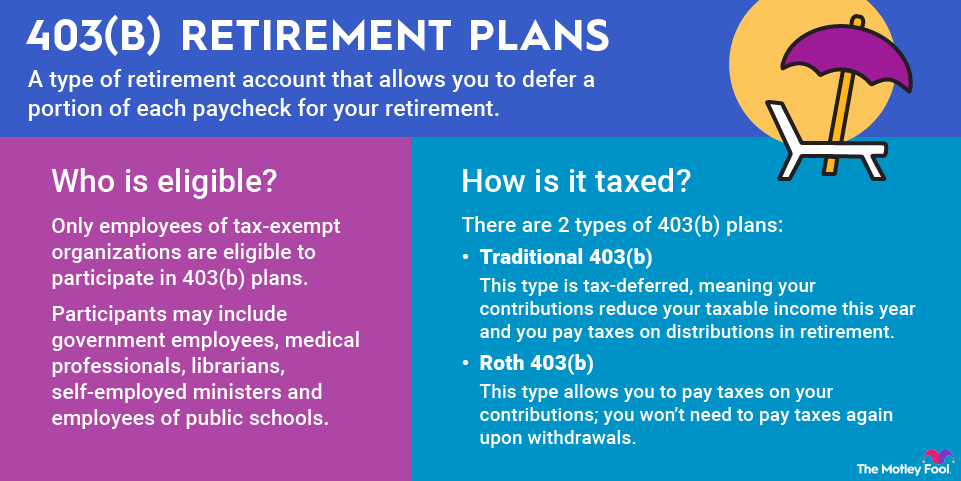

403(b) Plan: How it Works and Pros & Cons

38 States That Don't Tax Social Security Benefits

What is FICA tax? Understanding FICA for small business, fica tax

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons